Account Receivable

FOYCOM automates invoicing and payment tracking, ensuring timely collections and better cash flow management. Easily manage customer relationships with real-time updates and automated reminders.

Efficiently Manage Your Account Receivable

Challenges Of Account Receivable

Poor Process

Outdated processes can lead to errors, delays, & difficulties in managing accounts receivable effectively.

Tracking Issues

Difficulty in monitoring outstanding invoices and payment statuses.

Manually Process

Manual processing of invoices and tracking leads to various inefficiencies and mistakes.

Inaccurate Reporting

Ineffective reporting hampers the ability to assess and manage receivables effectively.

Delayed Payments

Late Payment The much unpredictable nature of late payment by customers adversely affects the operations of a business.

Dispute Resolution

All kinds of billing disputes can be soothed and require more time and resources.

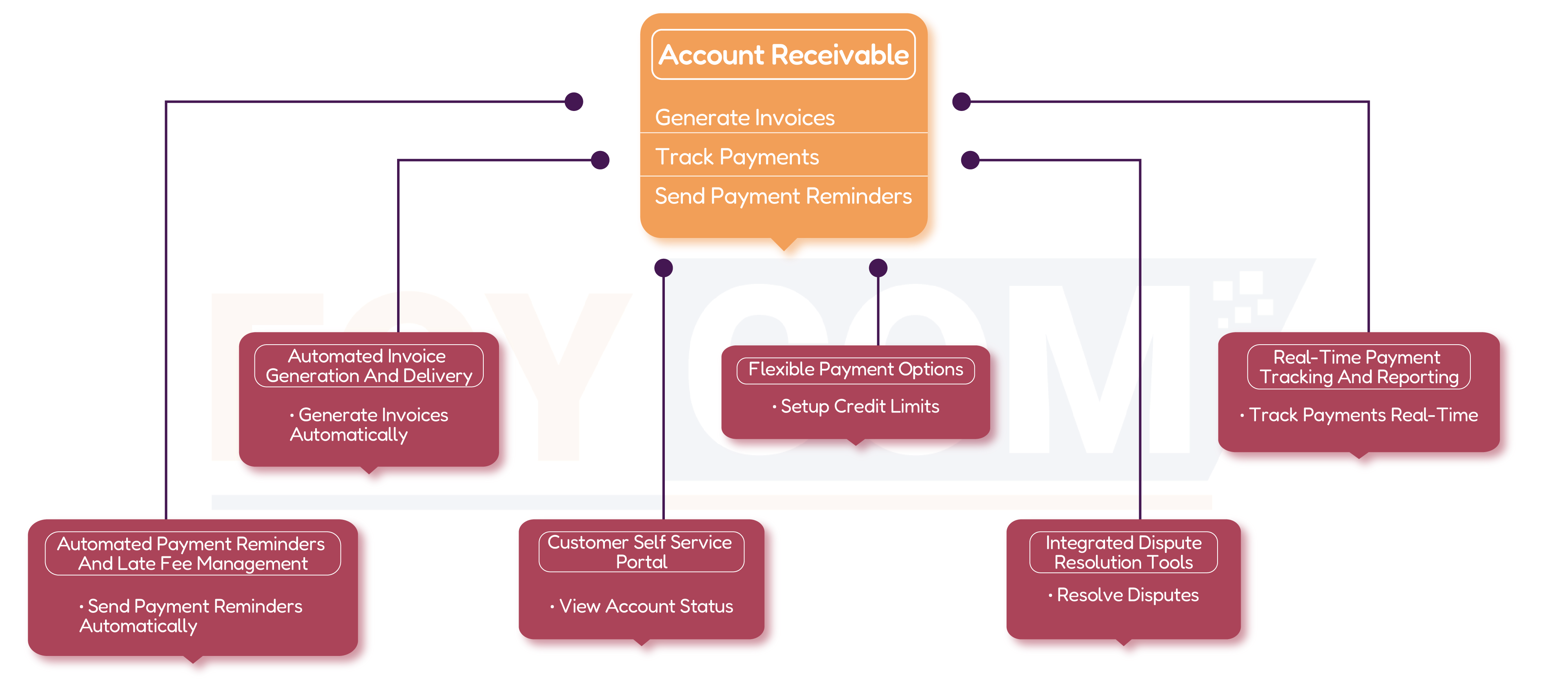

Key Features of Account Receivable

Automated Invoice Generation & Delivery

Flexible Payment Options

Real-Time Payment Tracking and Reporting

Automated Payment Reminders & Late Fee Management

Customer Self-Service Portal

Integrated Dispute Resolution Tools

Why Choose FOYCOM For Account Receivable ?

Efficient & Accurate Processing

Streamline your invoicing and payment tracking with FOYCOM's precision-driven automation.

Real-Time Visibility

Gain instant access to your receivables status with FOYCOM’s real-time reporting tools.

Cost Savings

Reduce operational costs with FOYCOM’s efficient accounts receivable management solutions.

Improved Customer Satisfaction

Enhance customer relationships through timely and accurate billing with FOYCOM.

Improved Operational Efficiency

Automates invoicing and payment processes, reducing manual errors and saving time.

Faster Payments

Streamlines payment workflows and reminders to accelerate cash flow.

Improved Visibility

Provides real-time insights into outstanding receivables and payment status

Enhanced Customer Relationships

Offers transparent billing and convenient payment options, improving customer satisfaction..

FAQs Related to Account Receivable

Accounts Receivable (AR) in a Wholesale ERP system is a module that manages the money owed to your company by customers for goods or services delivered. It handles processes like invoice generation, payment tracking, and customer account management.

To create a new customer invoice, navigate to the Accounts Receivable module, select 'Create New Invoice,' and fill in the necessary details such as customer name, invoice date, due date, item descriptions, quantities, and amounts. Save the invoice once all information is entered.

Yes, the system can generate recurring invoices automatically. Set up the recurring invoice schedule by specifying the frequency (e.g., weekly, monthly) and the duration. The system will then generate and send invoices as per the schedule.

If an invoice requires adjustments or corrections, navigate to the specific invoice, select 'Edit,' and make the necessary changes. Save the updated invoice, and the system will automatically adjust the records and notify the customer if required.

To record a customer payment, go to the Accounts Receivable module, select 'Record Payment,' and input the payment details such as customer name, payment amount, payment date, and method (e.g., cash, cheque, electronic transfer). Apply the payment to the corresponding invoice(s) and save.

Yes, bulk payments can be processed. Use the 'Bulk Payment' feature to select multiple invoices and record a single payment that covers them. The system will automatically distribute the payment across the selected invoices.

When recording a partial payment, enter the amount received and apply it to the respective invoice. The system will update the outstanding balance and track the remaining amount due.

To set credit limits, go to the customer’s profile, select 'Credit Management,' and input the desired credit limit amount. Save the changes, and the system will monitor the customer’s outstanding balance against this limit.

If a customer exceeds their credit limit, the system can flag the account and restrict further sales orders until payment is received. Notifications can be set up to alert both the customer and your accounts team.

The Accounts Receivable module allows you to generate various reports such as aging reports, payment history, customer statements, and outstanding receivables. These reports can be customized based on date ranges, customers, and other criteria.

To access reports, go to the 'Reports' section in the Accounts Receivable module. Select the type of report you need, set the parameters, and generate the report. You can view the reports online, download them, or schedule them to be sent to your email.

Yes, the Accounts Receivable module can integrate with other financial systems such as General Ledger, Inventory Management, and Sales Order Processing. This ensures seamless data flow and accurate financial reporting.